Prof. Siddharth Sengupta and myself played the Beer Distribution game in the class last week with students of the Operations stream in Alliance University. (click here for the shared doc)

There were three supply chains of 17 students each in the Operations stream of about 50 students.

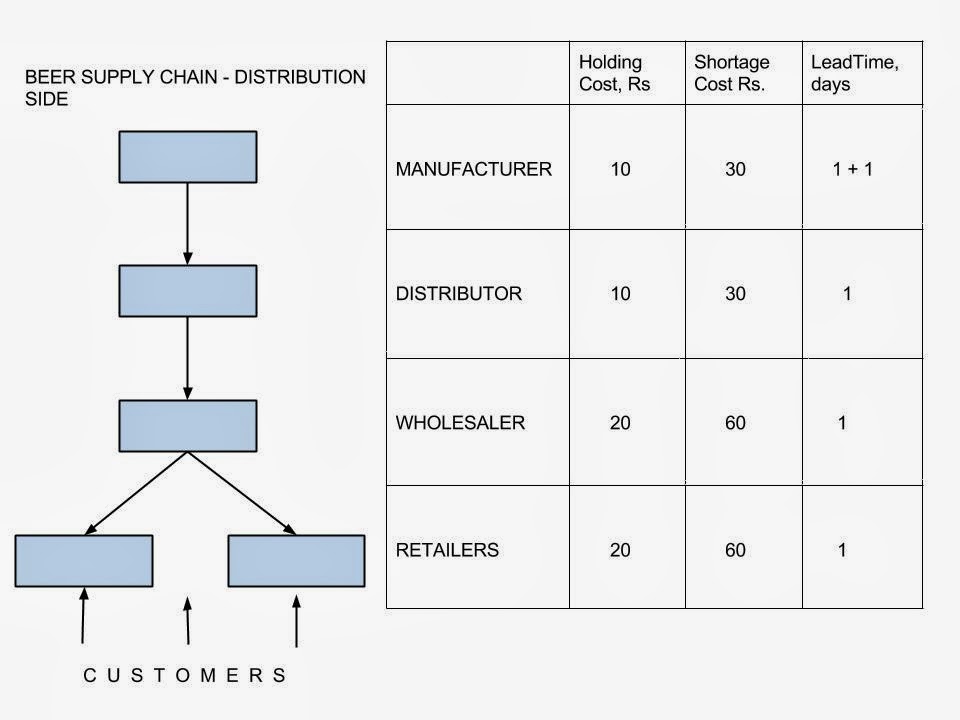

Each supply chain had two retailers taking orders from the customers. The retailers were placing orders with a wholesaler, the single wholesaler was placing orders with the single Distributor and the Distributor was placing orders with the single manufacturer.

It was so good to see the Bullwhip Effect in action because of the rational thinking of the players of the game ( the students themselves). This is indeed great learning for the students..

You can read my writeup on the Beergame ..

Ref :

ge..

There were three supply chains of 17 students each in the Operations stream of about 50 students.

Each supply chain had two retailers taking orders from the customers. The retailers were placing orders with a wholesaler, the single wholesaler was placing orders with the single Distributor and the Distributor was placing orders with the single manufacturer.

The Supply Chain C had the largest total cost, then supply chain B and least was for supply chain A. In all the cases, we found that the Mean of the orders placed by the entities were higher for supply chain C than for the other supply chains. Likewise the standard deviation of the orders placed by the supply chain C was higher than the other supply chains. This was clear indication that the bullwhip effect, which is nothing but the amplification of the variance of orders placed by downstream entity on an upstream entity as we go upstream in the supply chain is very pronounced for all the three supply chains. If we were comparing the relative values of the mean of the orders placed and the values of std dev. (variance) of the orders placed, we find for that these values are higher for supply chain C, than for supply chains B and A. This also goes to prove that the higher the variability in the orders placed, higher are the costs. This is because due to higher variance ( or SD) there are either higher numbers of items in stock, leading to high holding costs and to higher numbers of items short, leading to high shortage costs. This goes to prove that Bullwhip Effect not only plays havoc with your inventory stock, it also increases your costs, affecting the bottomline of the organisation. The reasons for these costs are as under ( Lee et al, '97) 1. Demand forecast updating : the rational thinking on the part of the players - thinking that the orders will either increase or decrease, the upstream entities either placed large numbers of items as orders or less numbers of items, forced them to place larger or lesser orders. | | ||||||||||||||||

| 2. Rationing and shortage gaming : the single wholesaler was supplying to two retailers, naturally there was rationing and the retailers placed larger orders to avoid being shortsupplied. | |||||||||||||||||

| 3. Impact of leadtimes of replenishment : the replenishment happening after passage of a fixed period of time and the pipeline inventory thence was forgotten by the entities while placing orders, leading to higher inventory on order and delivery. | |||||||||||||||||

| 4. The negative impact felt by the backorders forced entities to order more than what was actually needed. | |||||||||||||||||

| 5. Order batching and price fluctuations did not happen in this instance and hence its effect on the bullwhip phenomenon has been ruled out. | |||||||||||||||||

| Another cause which we wanted to highlight was the impact of leadtimes. It has been seen earlier while playing other versions of the game, higher leadtime of replenishment also results in higher costs of the supply chain. | |||||||||||||||||

| The delay in getting the replenishment stocks due to high leadtimes, leads to panic among the ordering entities, who place larger orders , unmindful that stocks are in the pipeline. Finally when stocks arrive, there is a glut and this causes excess holding costs. | |||||||||||||||||

It was so good to see the Bullwhip Effect in action because of the rational thinking of the players of the game ( the students themselves). This is indeed great learning for the students..

You can read my writeup on the Beergame ..

Ref :

The bullwhip effect in supply chains- Hau L Lee; V Padmanabhan; Seungjin Whang, MIT Sloan Management Review; Spring 1997

ge..

Wonderfully written in a lucid and easy-to-understand fashion

ReplyDelete